Don't Face Financial Challenges Alone

We're Here to Guide You

Differences in Financial Values

Couples often come from different financial backgrounds or have differing attitudes towards money. This can lead to conflicts over spending, saving, and investing.

Communication Breakdown

Lack of communication about financial matters can create misunderstandings and resentment. Couples may avoid discussing money due to discomfort or fear of judgment.

Financial Infidelity

Hidden debts, secret accounts, or undisclosed spending can erode trust in a relationship and cause significant strain.

Power Struggles

Money can become a source of power dynamics within a relationship, leading to feelings of inequality or control issues.

Lack of Financial Literacy

Limited knowledge about personal finance can exacerbate money-related issues within a relationship. Couples may struggle to make informed decisions or manage financial challenges effectively.

Unequal Contributions

Disparities in income or financial responsibilities can lead to feelings of resentment or imbalance within the relationship.

Numbers Don't Lie

Did you Know?

70% of couples argue about money more than anything else

Nearly 1 in 3 divorces are due to financial stress

A Bankrate survey revealed that 40% of Americans in committed relationships have committed financial infidelity, which includes keeping financial secrets.

Master Money Together!

Every Couple Deserves the Right Tools to Succeed Financially

Access our training and workbooks immediately and start transforming your financial conversations today.

Brunch N' Budgets for Lovers

For couples who prefer a more immersive, in-person experience, we have a special event called ‘Brunch & Budgets’ on August 17th at The Lola.

Take part in a relaxed and enjoyable brunch where couples can connect with each other and engage in live Q&A while learning strategies to build wealth.

better communication

brunch

networking

actionable insights

3 Pillars of Financial Success

Sustaining Your Financial Wellbeing

We provide strategies that sustain and enhance the positive momentum you have created financially to ensure a more secure future.

Executing Your Financial Plan

Taking intentional steps, making strategic decisions, and staying disciplined to achieve your financial goals.

Growing Your Wealth

Making smart investments, strategic planning, and seizing opportunities for financial expansion.

Beyond the Portfolio

Personalized Guidance

Tailored, individualized financial advice and support.

Peace of Mind

Providing reassurance by alleviating your financial concerns.

Free your Time

Regain time with financial freedom.

Education

Having the financial knowledge to make informed decisions.

What is Financial Planning?

About us

At Deasil Wealth Management, we serve as your personal guide to financial success. From one-on-one guidance to inspiring talks, our mission is to help communities thrive by building wealth.

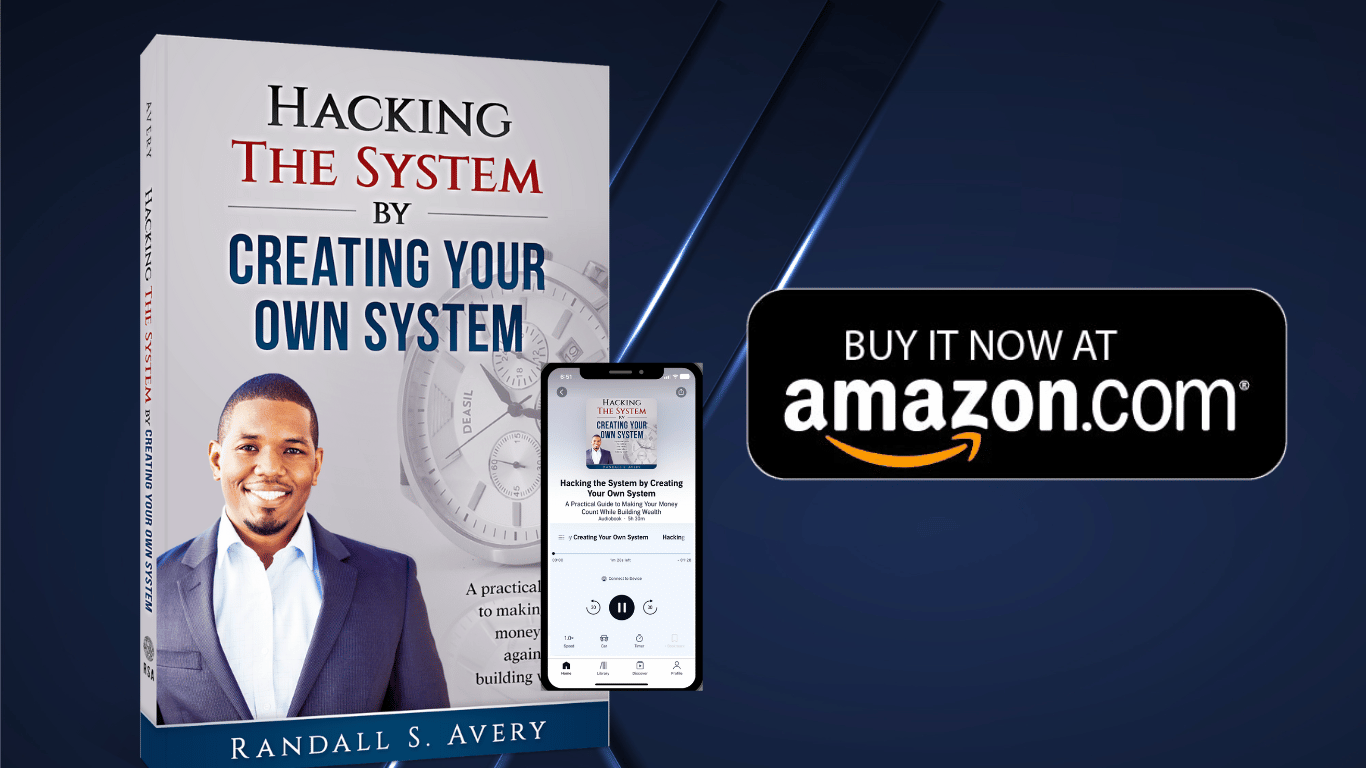

Randall Avery, CFP®, CFA

As a trusted, Fee-Only, CERTIFIED FINANCIAL PLANNER®. Allow me to be your guide to financial freedom! With over 15 years of experience helping people with money, I understand the unique needs of pre-retirees, self-employed individuals, and practice owners like you.

Schedule a Call

Discuss your financial concerns and learn more about Deasil Wealth Management.

goals & Information gathering

Identifying and prioritizing your financial goals and discussing the solutions we can provide.

Financial Peace

Find peace and confidence while executing your financial plan.

Pricing & Fees

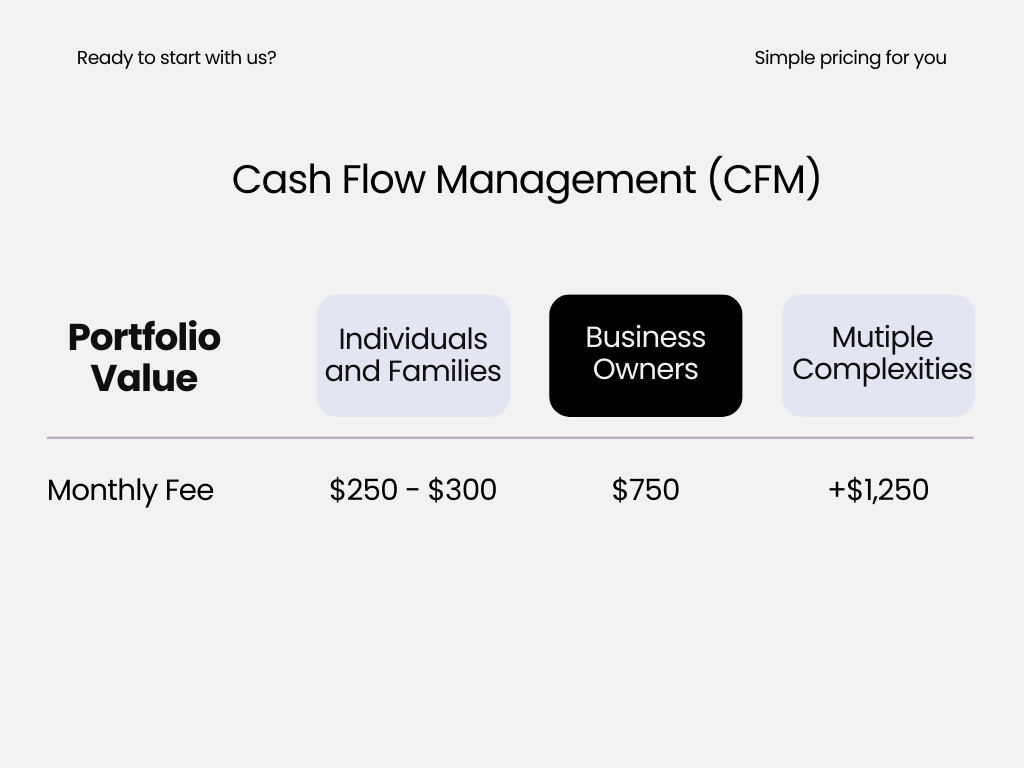

CFM - Cash Flow Management

CFM - Cash Flow Management

WE LOOK AT THE DETAILS FOR YOU

We are committed to helping you understand your cash flow, identifying areas for improvement, and reaching your financial goals.

- Personalized Guidance: Receive one-on-one guidance from a dedicated financial planner who understands your financial goals and challenges.

- Financial Clarity: Gain a clear understanding of your cash flow and where your money is going each month.

- Budget Optimization: Identify areas for improvement and create a customized budget that aligns with your lifestyle and goals.

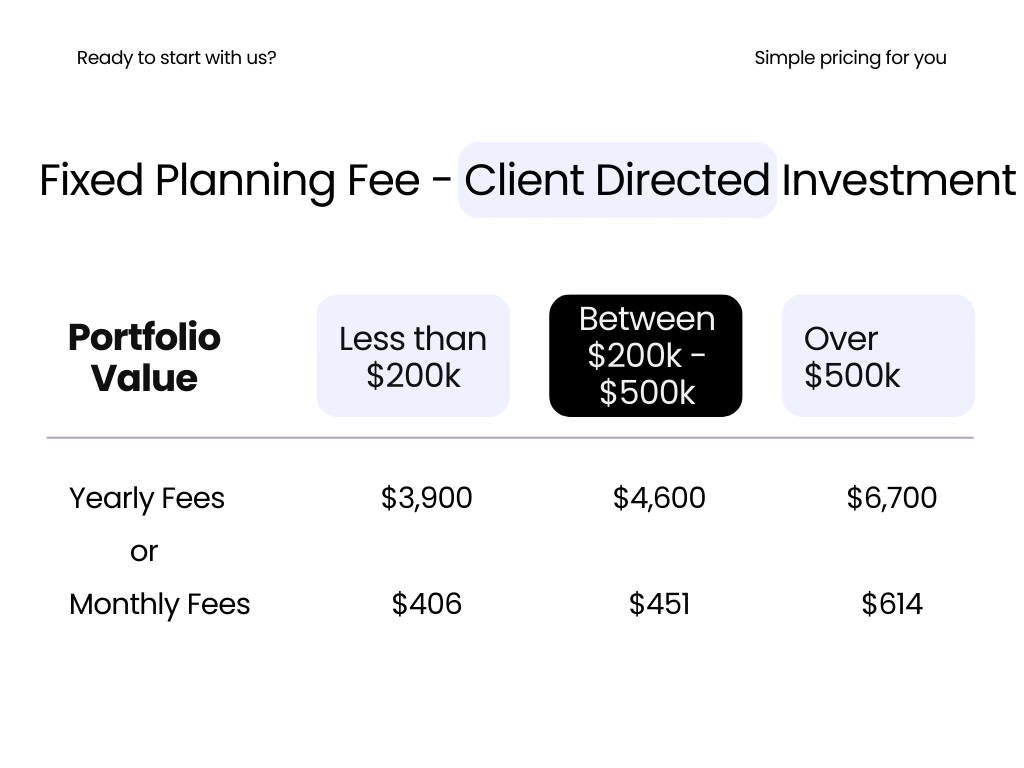

DIY - Do It Yourself

less structure and more contral

Invest independently with the assistance of a financial planner. Retain direct control over your investments and make decisions in real-time based on your individual preferences and market conditions.

Frequently Asked Questions

A financial planner specializing in couples’ finances helps partners align their financial goals, create a budget, manage debt, plan for major life events like buying a house or having children, and invest wisely for the future.

Financial planning together fosters transparency, trust, and shared goals. It helps you both understand each other’s financial habits, values, and aspirations, leading to a stronger financial foundation for your relationship.

Differences in financial goals and habits are common among couples. As your financial planner, I’ll facilitate open communication and help you find common ground. Through compromise and understanding, we’ll craft a plan that respects both partners’ priorities while working towards shared objectives.

Income disparities can add complexity to financial planning, but they don’t have to be a barrier to financial harmony. We’ll explore strategies to leverage both partners’ strengths and resources effectively, ensuring that your financial plan reflects both your combined income and individual contributions.

Absolutely. As a financial planner, I adhere to strict confidentiality standards. Your financial information and discussions will remain strictly confidential, fostering an environment of trust and privacy.

Simply reach out to schedule an initial consultation. During this meeting, we’ll discuss your financial goals, assess your needs, and determine how I can best support you in achieving financial success as a couple.

Add Your Heading Text Here

At Deasil Wealth Management, we serve as your personal guide to financial success. From one-on-one guidance to inspiring talks, our mission is to help communities thrive by building wealth.

Quick Links

Get In Touch

© All Rights Reserved.