Plan Today, Prosper Tomorrow

From investments to retirement planning, we are here to guide you towards a stable and prosperous future.

Don't Face Financial Challenges Alone

We're Here to Guide You

Retirement Complexity

Planning for retirement becomes more complex with higher incomes, as individuals may have access to additional retirement savings vehicles such as SEP-IRAs, solo 401(k)s, or deferred compensation plans.

Wealth Preservation

As you grow your wealth, you will often have substantial assets to protect, which requires careful estate planning and risk management.

Taxes

Managing taxes becomes increasingly complex with higher incomes. Failing to optimize can result in paying more taxes than necessary.

Goal Setting and Life Planning

You may have complex aspirations and goals beyond just accumulating wealth.

Family Dynamics

Wealth can bring its own set of complexities to family relationships. We help navigate potentially difficult conversations surrounding wealth transfer and establishing a shared vision for the family's legacy.

Life Transitions

Life is full of transitions and unexpected events, from job changes and career transitions to illness, divorce, or loss of a loved one.

3 Pillars of Financial Success

Sustaining Your Financial Wellbeing

We provide strategies that sustain and enhance the positive momentum you have created financially to ensure a more secure future.

Executing Your Financial Plan

Taking intentional steps, making strategic decisions, and staying disciplined to achieve your financial goals.

Growing Your Wealth

Making smart investments, strategic planning, and seizing opportunities for financial expansion.

Beyond the Portfolio

Personalized Guidance

Tailored, individualized financial advice and support.

Peace of Mind

Providing reassurance by alleviating your financial concerns.

Free your Time

Regain time with financial freedom.

Education

Having the financial knowledge to make informed decisions.

What is Financial Planning?

About us

At Deasil Wealth Management, we serve as your personal guide to financial success. From one-on-one guidance to inspiring talks, our mission is to help communities thrive by building wealth.

Randall Avery, CFP®, CFA

As a trusted, Fee-Only, CERTIFIED FINANCIAL PLANNER®. Allow me to be your guide to financial freedom! With over 15 years of experience helping people with money, I understand the unique needs of pre-retirees, self-employed individuals, and practice owners like you.

Schedule a Call

Discuss your financial concerns and learn more about Deasil Wealth Management.

goals & Information gathering

Identifying and prioritizing your financial goals and discussing the solutions we can provide.

Financial Peace

Find peace and confidence while executing your financial plan.

Pricing & Fees

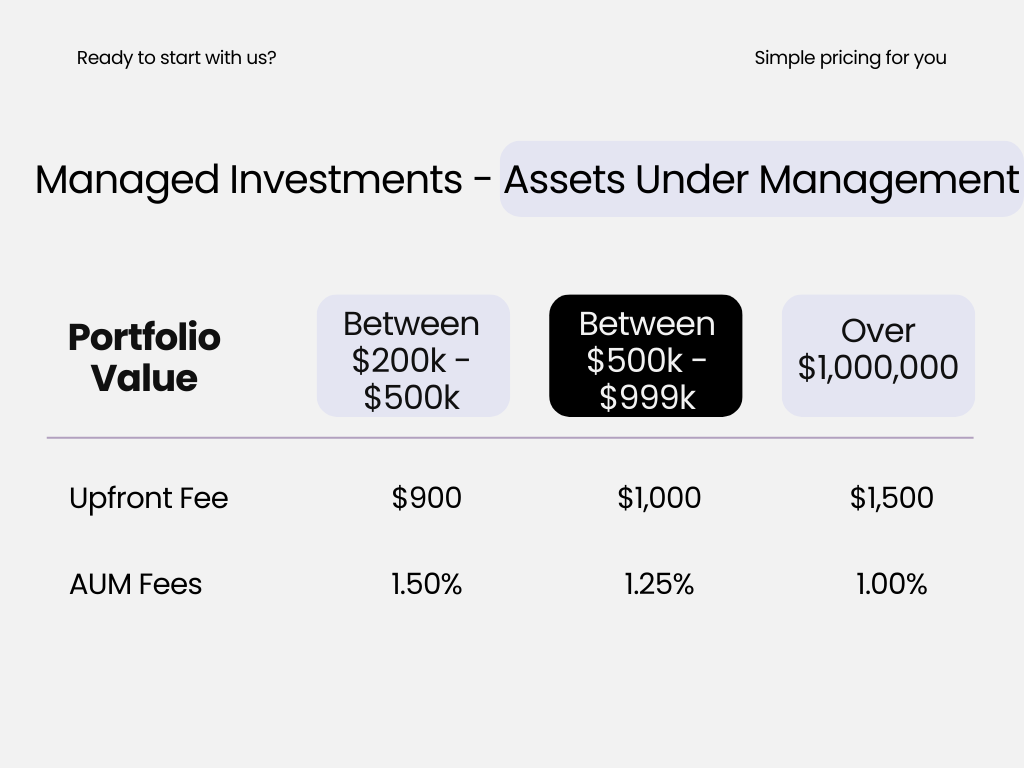

AUM - Assets Under Management

We do all the heavy Lifting

The AUM model provides peace of mind, knowing that professional expertise is dedicated to managing your investments for long-term success. You benefit from a transparent fee structure directly tied to the value of your managed assets.

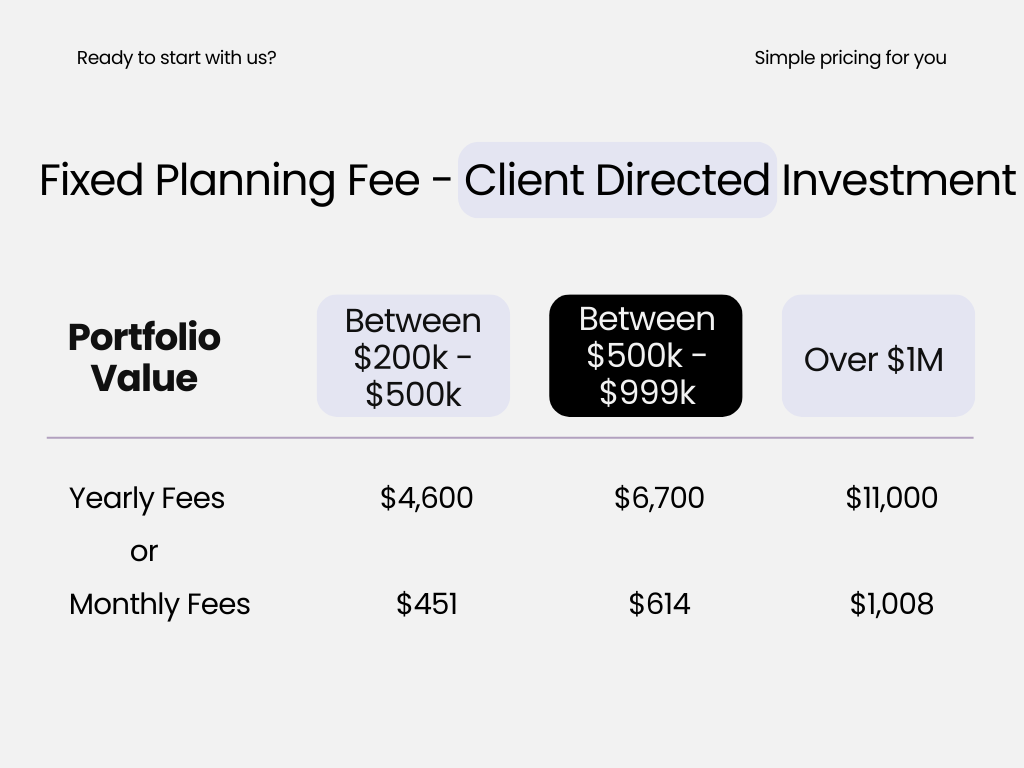

DIY - Do It Yourself

less structure and more contral

Invest independently with the assistance of a financial planner. Retain direct control over your investments and make decisions in real-time based on your individual preferences and market conditions.

Frequently Asked Questions

A financial planner helps individuals and families navigate their financial lives by providing expert advice and guidance on a wide range of financial matters. This includes retirement planning, investment management, tax planning, estate planning, risk management (insurance), budgeting, and debt management. Financial planners work closely with clients to understand their unique goals and circumstances and develop customized strategies to help them achieve financial security and success.

If you’re feeling overwhelmed or unsure about your financial situation, or if you have specific financial goals you want to achieve but don’t know how to get there, it may be time to consider working with a financial planner. Whether you’re planning for retirement, saving for a major purchase like a home or college education, or simply want help managing your finances more effectively, a financial planner can provide valuable expertise and guidance to help you reach your goals.

When choosing a financial planner, it’s important to look for someone who has the appropriate credentials and qualifications to provide financial advice. Some common credentials to look for include Certified Financial Planner (CFP), Chartered Financial Consultant (ChFC), Chartered Financial Analyst (CFA), and Personal Financial Specialist (PFS). These designations indicate that the individual has met certain education, experience, and ethical standards in the field of financial planning.

If you’re ready to take control of your financial future and achieve your goals, the first step is to schedule a consultation with a qualified financial planner. During your initial meeting, you’ll have the opportunity to discuss your financial goals, concerns, and objectives, and learn more about how a financial planner can help you achieve them.

Add Your Heading Text Here

At Deasil Wealth Management, we serve as your personal guide to financial success. From one-on-one guidance to inspiring talks, our mission is to help communities thrive by building wealth.

Quick Links

Get In Touch

© All Rights Reserved.