Cash Flow Managment

The engine that drives the financial planning process is cash-flow

Don't Face Financial Challenges Alone

We're Here to Guide You

No Emergency Fund

Without an emergency fund, unexpected expenses can lead you into debt. Many people struggle to build up an emergency fund due to competing financial priorities..

Impulsive Spending

Impulse buying can quickly derail your savings efforts. People often struggle with controlling their spending on non-essential items.

Limited Income

Low wages or irregular income can make it difficult for you to save money. People in these situations often find themselves living paycheck to paycheck.

Lack of Financial Goals

Without clear financial goals, you may lack motivation and direction in your savings efforts. Setting financial goals can provide a roadmap for successful money management.

Debt Repayment

Existing debt, such as credit card debt or student loans, can hinder savings efforts. Balancing debt repayment with saving can be challenging.

Procrastination

Fear of dealing with financial matters or the complexity of financial tasks can lead to procrastination and avoidance behavior.

3 Pillars of Financial Success

Sustaining Your Financial Wellbeing

We provide strategies that sustain and enhance the positive momentum you have created financially to ensure a more secure future.

Executing Your Financial Plan

Taking intentional steps, making strategic decisions, and staying disciplined to achieve your financial goals.

Growing Your Wealth

Making smart investments, strategic planning, and seizing opportunities for financial expansion.

Beyond the Portfolio

Personalized Guidance

Tailored, individualized financial advice and support.

Peace of Mind

Providing reassurance by alleviating your financial concerns.

Free your Time

Regain time with financial freedom.

Education

Having the financial knowledge to make informed decisions.

What is Financial Planning?

About us

At Deasil Wealth Management, we serve as your personal guide to financial success. From one-on-one guidance to inspiring talks, our mission is to help communities thrive by building wealth.

Randall Avery, CFP®, CFA

As a trusted, Fee-Only, CERTIFIED FINANCIAL PLANNER®. Allow me to be your guide to financial freedom! With over 15 years of experience helping people with money, I understand the unique needs of pre-retirees, self-employed individuals, and practice owners like you.

Schedule a Call

Discuss your financial concerns and learn more about Deasil Wealth Management.

goals & Information gathering

Identifying and prioritizing your financial goals and discussing the solutions we can provide.

Financial Peace

Find peace and confidence while executing your financial plan.

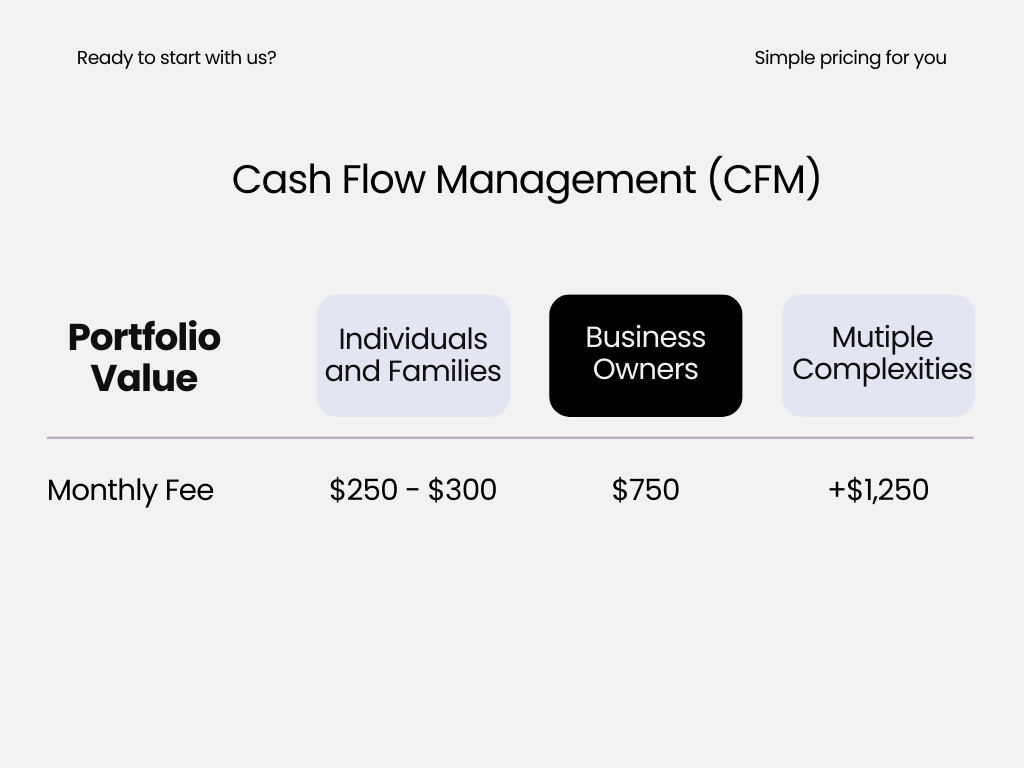

Pricing & Fees

CFM - Cash Flow Management

We look at the details for you

We are committed to helping you understand your cash flow, identifying areas for improvement, and reaching your financial goals.

- Personalized Guidance: Receive one-on-one guidance from a dedicated financial planner who understands your financial goals and challenges.

- Financial Clarity: Gain a clear understanding of your cash flow and where your money is going each month.

- Budget Optimization: Identify areas for improvement and create a customized budget that aligns with your lifestyle and goals.

Frequently Asked Questions

Cash flow management involves tracking the inflow and outflow of money in your personal or business finances. It’s crucial because it helps you understand how money moves in and out of your accounts, enabling you to make informed decisions about spending, saving, and investing.

A financial planner can provide expert guidance and support to help you effectively manage your cash flow. They can analyze your income sources, expenses, debt obligations, and financial goals to develop a cash flow management strategy that aligns with your objectives.

During cash flow management sessions, your financial planner will review your income sources, expenses, debt obligations, and financial goals. They will work with you to identify areas for improvement and develop strategies to optimize your cash flow. They may also provide education and resources to help you improve your financial literacy and decision-making skills.

If you’re ready to take control of your financial future and achieve your goals, the first step is to schedule a consultation with a qualified financial planner. During your initial meeting, you’ll have the opportunity to discuss your financial goals, concerns, and objectives, and learn more about how a financial planner can help you achieve them.

To get started, schedule a consultation with a financial planner to discuss your financial situation and goals. They will help you develop a personalized cash flow management plan to optimize your finances and achieve your objectives. With their expertise and support, you can take control of your cash flow and work towards a brighter financial future.

Add Your Heading Text Here

At Deasil Wealth Management, we serve as your personal guide to financial success. From one-on-one guidance to inspiring talks, our mission is to help communities thrive by building wealth.

Quick Links

Get In Touch

© All Rights Reserved.