Couples Bank Accounts

As a married couple, many options exist for managing your bank accounts

Couples Bank Account

Disclaimer – Before we go into this article, the information below assumes you and your partner have aligned financial goals. If you and your partner are not on the same page with money, please review my article on Reducing Money Arguments with your Spouse. Once you two are on the same page with money, we can move on to the article below.

Types of Accounts

As a married couple, many options exist for managing your bank accounts. We will first talk about the different types of couples accounts to consider:

- Joint account – Both partners can access and manage the money. Joint accounts are typically used to cover shared expenses like rent, utilities, groceries, and other household expenses.

- Separate accounts: You can also choose to keep your accounts separate. This can be useful for managing personal expenses like hobbies or gifts for family members.

Most couples will have a combination of both joint and separate accounts. For example, you could have a joint account for shared expenses and individual accounts for personal expenses. The key is to have open and honest communication with your spouse about the structure of your accounts and to come up with a plan for your accounts that works best for your union.

Splitting Household Expenses

As an advisor, there are so many ways I have seen couples manage their household expenses:

- 50/50 – Some split the bills down the middle, and each partner contributes 50% towards the household expenses.

- Proportional – If one partner earns significantly more than the other, you may want to split the bills proportionally to your income. For example, if one partner earns 60% of the total income, they can contribute 60% towards the expenses while the other partner contributes 40%.

- Bill Assignment – Couples predetermine who pays what bills. For example, someone will pay the mortgage while someone else will pay the car note. Both parties understand their assignment, and expenses are usually paid out of a separate account rather than a joint one.

Who Pays the Bills?

Next, couples must determine who will submit payment for each bill. This can be the same or a different person from who earns the money. I have seen a lot of cases where the breadwinner of the family is not the one who pays the bills. Here are three different ways you can handle who pays the bills:

- One partner pays all the bills and controls the finances for the couple

- Both partners have an assigned bill that they are responsible for managing

- More than likely, it will be a combination of the two

How couples determine who does what is all preference. Factors like who is better organized or enjoys handling finances contribute greatly to this decision. As a professional preference, I am a fan of a combination approach based on the couples’ individual dynamics.

The partner who does not have bill payment responsibilities should not be kept in the dark concerning the household bills. The bill-paying party should report back the status of all the bills and any challenges they have with managing everything. The non-bill-paying party is also responsible for looking for opportunities to improve the household finances, even though they are not the ones making the payments.

Couple’s Bank Account Structure

Now that we have the basics of managing money as a couple and you have decided with your partner the best way to handle the joint expenses, we can turn to setting up our bank accounts.

Recommendation

There are two bank account models I recommend couples follow

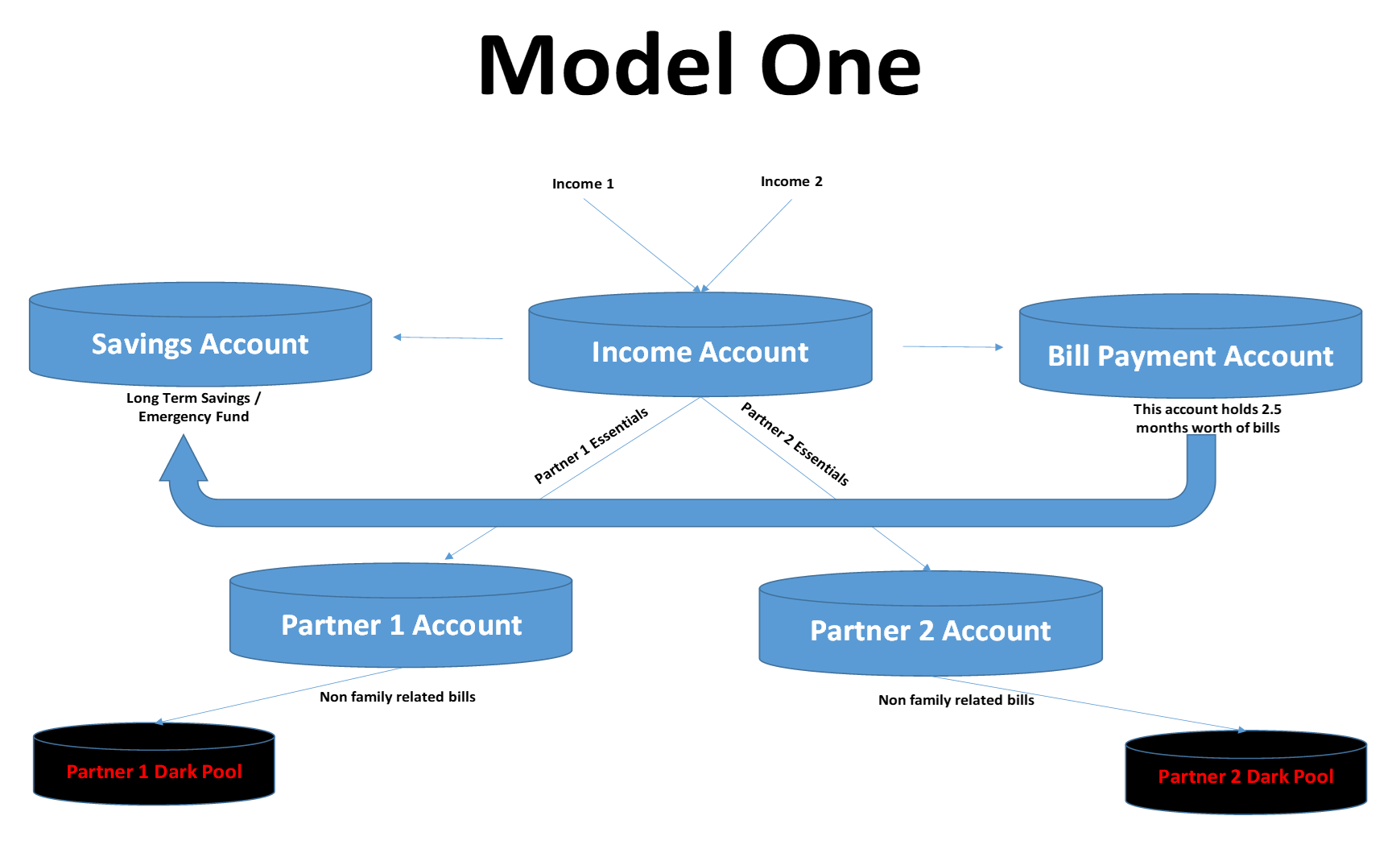

- Model One – This model is reserved for younger couples or couples where transparency and working together with money are important. Model One works when a couple’s spending habits are similar and they have a similar value system when it comes to money.

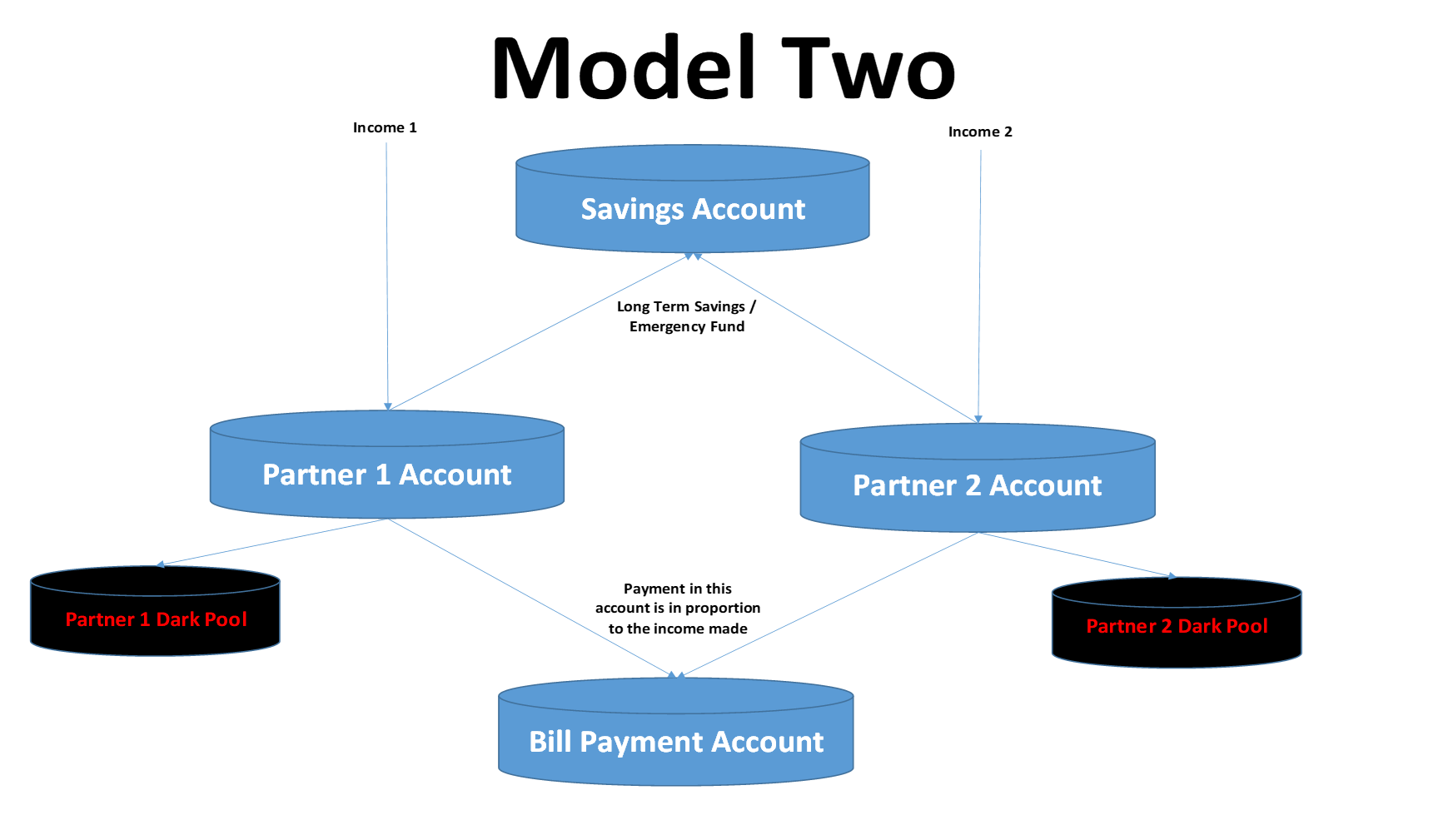

- Model Two – Is for couples who come together later in life or whose spending values differ significantly. A large portion of the bills are usually paid separately, each has separate goals on what they want to do with their income, and/or they wish to retain some level of control over their finances. This approach can be useful for couples who want to maintain financial independence or have different financial goals and spending habits.

Example #1

Both parties’ income is deposited into a joint income account

This income account will fund the Joint Savings Account and the Joint Bill Payment Account. The Bill Payment Account should not hold more than 2 months’ worth of living expenses. Any amount over this 2 months’ worth of living expenses should be transferred to long-term savings. The theory is that most of your regular expenses and emergencies should be covered by this amount.

The reason for a separate income account is the bill payment account is more susceptible to fraud or errors. If the bill payment account is compromised, hopefully, the couple’s income account and savings account will not be at risk, and you will still receive your direct deposits or recurring transfers.

The bill payment account will be used to pay all of the household bills, loans, and credit cards. Link all of your automatic (ACH) payments and utility bills to this account. The Bill Payment Account is the only account where a debit card is regularly used and checks are written. This process will limit criminals to doing only so much damage to your cash holdings if your account is compromised.

Your savings account will be used for an emergency fund. After this account reaches six months of living expenses, consider opening an investment account to increase the returns you can earn on your cash holdings.

Each partner will have an agreed-upon amount that is transferred into their individual accounts.

Lastly, there is a dark pool account. This account is also an agreed-upon amount that each person can spend without the other person’s oversight. It allows some level of individuality and freedom.

Example #2

Each partner has an income account that they manage

In Model Two, each partner has an income account that they manage.

Every month each partner will transfer money into the couple’s savings account and their bill payment account as the couple has agreed upon. This should cover their joint bills and fund their long-term joint savings goals.

Each person will still have a dark pool account where they can spend money, pay other bills, and have other savings accounts without worrying about the other person monitoring their spending.

Summary

It is important to discuss the options with your partners and find an approach that works best for both partners. It is also important to communicate regularly about finances to ensure that both partners are on the same page. Having a predetermined monthly check-in to go over the numbers is important to make sure things don’t slip through the cracks.

My clients have found that having a financial advisor to aid in these talks has helped them move forward on their financial journey. If you would like to discuss how a financial advisor can improve your relationship with money, please use the link below for us to have a call.

Don't miss our next article

Helping subscribers understand complex financial concepts, investment strategies, retirement planning, and more.

Add Your Heading Text Here

At Deasil Wealth Management, we serve as your personal guide to financial success. From one-on-one guidance to inspiring talks, our mission is to help communities thrive by building wealth.

Quick Links

Get In Touch

© All Rights Reserved.