Frequently Asked Questions

It’s never too late to start planning for retirement. As a financial planner, I specialize in creating tailored strategies to maximize your savings potential and achieve your retirement goals. Let’s work together to secure your financial future and make your retirement dreams a reality.

If you’re feeling overwhelmed or unsure about your financial situation, or if you have specific financial goals you want to achieve but don’t know how to get there, it may be time to consider working with a financial planner. Whether you’re planning for retirement, saving for a major purchase like a home or college education, or simply want help managing your finances more effectively, a financial planner can provide valuable expertise and guidance to help you reach your goals.

If you’re ready to take control of your financial future and achieve your goals, the first step is to schedule a consultation with a qualified financial planner. During your initial meeting, you’ll have the opportunity to discuss your financial goals, concerns, and objectives, and learn more about how a financial planner can help you achieve them.

A financial planner helps individuals and families navigate their financial lives by providing expert advice and guidance on a wide range of financial matters. This includes retirement planning, investment management, tax planning, estate planning, risk management (insurance), budgeting, and debt management. Financial planners work closely with clients to understand their unique goals and circumstances and develop customized strategies to help them achieve financial security and success.

Virtual financial planning allows us to connect seamlessly through video calls, emails, and secure online platforms. We leverage cutting-edge technology to ensure secure communication and efficient collaboration, making it convenient for you to access financial advice from anywhere.

Simply reach out to schedule an initial consultation. During this meeting, we’ll discuss your financial goals, assess your needs, and determine how I can best support you in achieving financial success as a couple.

As a fee-only financial planner, I am compensated solely by the fees paid by my clients. I don’t earn commissions or sell financial products, ensuring that my advice is unbiased and always in your best interest.

As a fiduciary, I am legally obligated to act in your best interest. This means I prioritize your financial well-being above all else, providing transparent and objective advice to help you achieve your goals.

When choosing a financial planner, it’s important to look for someone who has the appropriate credentials and qualifications to provide financial advice. Some common credentials to look for include Certified Financial Planner (CFP), Chartered Financial Consultant (ChFC), Chartered Financial Analyst (CFA), and Personal Financial Specialist (PFS). These designations indicate that the individual has met certain education, experience, and ethical standards in the field of financial planning.

Cash flow management involves tracking the inflow and outflow of money in your personal or business finances. It’s crucial because it helps you understand how money moves in and out of your accounts, enabling you to make informed decisions about spending, saving, and investing.

A financial planner can provide expert guidance and support to help you effectively manage your cash flow. They can analyze your income sources, expenses, debt obligations, and financial goals to develop a cash flow management strategy that aligns with your objectives.

During cash flow management sessions, your financial planner will review your income sources, expenses, debt obligations, and financial goals. They will work with you to identify areas for improvement and develop strategies to optimize your cash flow. They may also provide education and resources to help you improve your financial literacy and decision-making skills.

If you’re ready to take control of your financial future and achieve your goals, the first step is to schedule a consultation with a qualified financial planner. During your initial meeting, you’ll have the opportunity to discuss your financial goals, concerns, and objectives, and learn more about how a financial planner can help you achieve them.

To get started, schedule a consultation with a financial planner to discuss your financial situation and goals. They will help you develop a personalized cash flow management plan to optimize your finances and achieve your objectives. With their expertise and support, you can take control of your cash flow and work towards a brighter financial future.

A financial planner specializing in couples’ finances helps partners align their financial goals, create a budget, manage debt, plan for major life events like buying a house or having children, and invest wisely for the future.

Financial planning together fosters transparency, trust, and shared goals. It helps you both understand each other’s financial habits, values, and aspirations, leading to a stronger financial foundation for your relationship.

Differences in financial goals and habits are common among couples. As your financial planner, I’ll facilitate open communication and help you find common ground. Through compromise and understanding, we’ll craft a plan that respects both partners’ priorities while working towards shared objectives.

Income disparities can add complexity to financial planning, but they don’t have to be a barrier to financial harmony. We’ll explore strategies to leverage both partners’ strengths and resources effectively, ensuring that your financial plan reflects both your combined income and individual contributions.

Absolutely. As a financial planner, I adhere to strict confidentiality standards. Your financial information and discussions will remain strictly confidential, fostering an environment of trust and privacy.

Pricing & Fees

AUM - Assets Under Management

We do all the heavy Lifting

The AUM model provides peace of mind, knowing that professional expertise is dedicated to managing your investments for long-term success. You benefit from a transparent fee structure directly tied to the value of your managed assets.

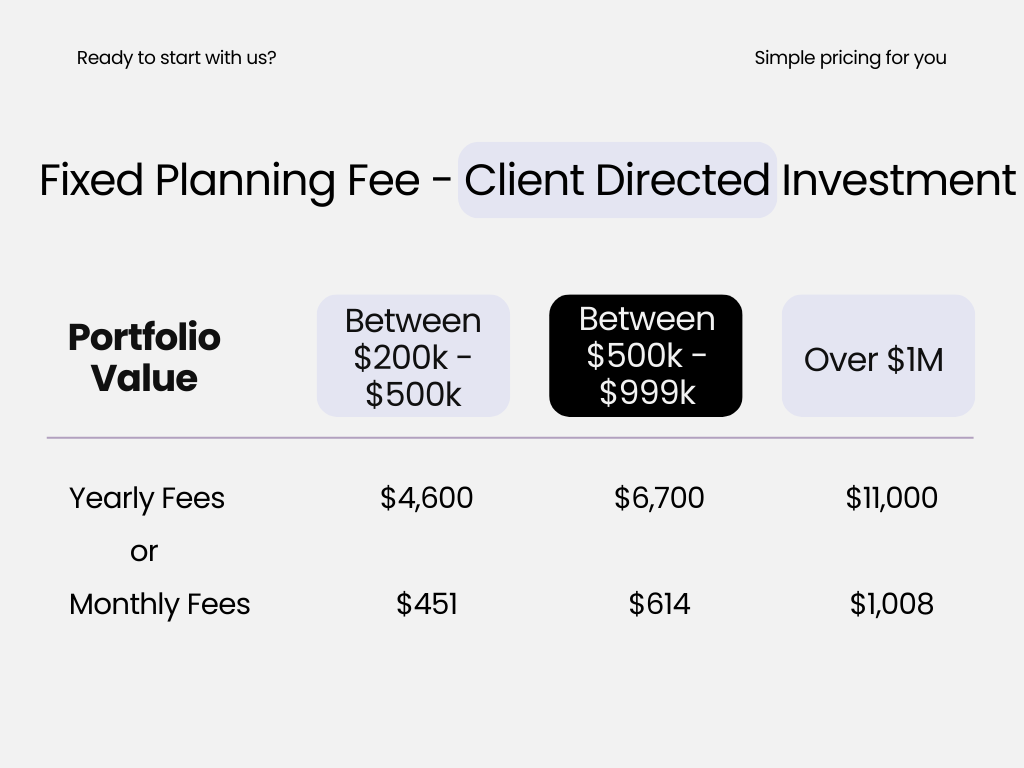

DIY - Do It Yourself

less structure and more contral

Invest independently with the assistance of a financial planner. Retain direct control over your investments and make decisions in real-time based on your individual preferences and market conditions.

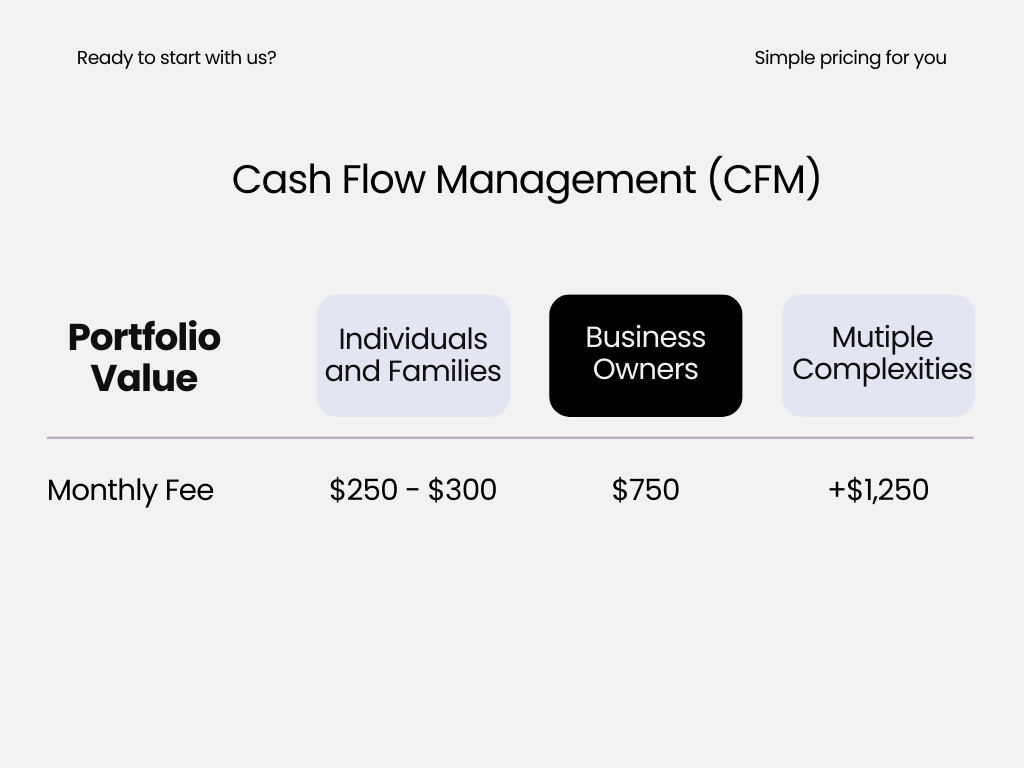

CFM - Cash Flow Management

We look at the details for you

We are committed to helping you understand your cash flow, identifying areas for improvement, and reaching your financial goals.

- Personalized Guidance: Receive one-on-one guidance from a dedicated financial planner who understands your financial goals and challenges.

- Financial Clarity: Gain a clear understanding of your cash flow and where your money is going each month.

- Budget Optimization: Identify areas for improvement and create a customized budget that aligns with your lifestyle and goals.

Schedule a Call

Discuss your financial concerns and learn more about Deasil Wealth Management.

goals & Information gathering

Identifying and prioritizing your financial goals and discussing the solutions we can provide.

Financial Peace

Find peace and confidence while executing your financial plan.

Add Your Heading Text Here

At Deasil Wealth Management, we serve as your personal guide to financial success. From one-on-one guidance to inspiring talks, our mission is to help communities thrive by building wealth.

Quick Links

Get In Touch

© All Rights Reserved.